Federal Employees, Are Your Portfolios on Track?

Understand Held Away Account Management & How To Maximize Your Employer Based Retirement Savings.

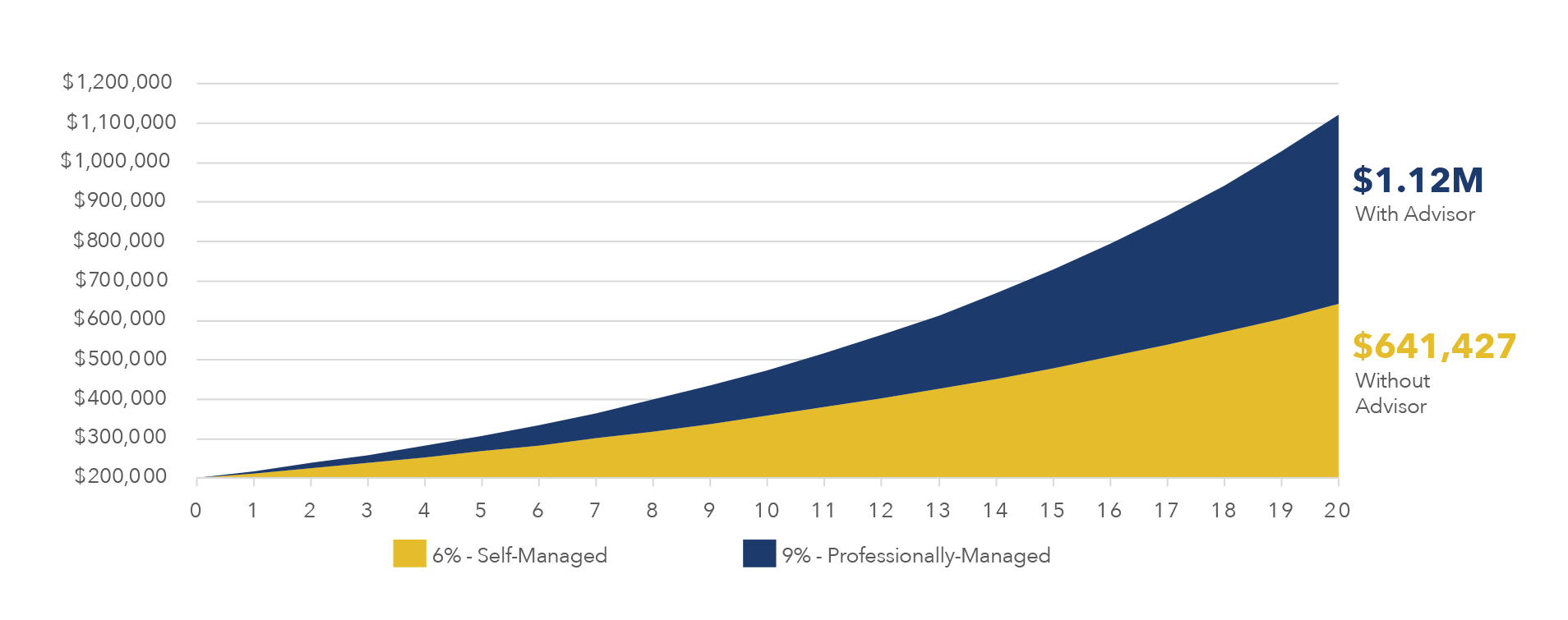

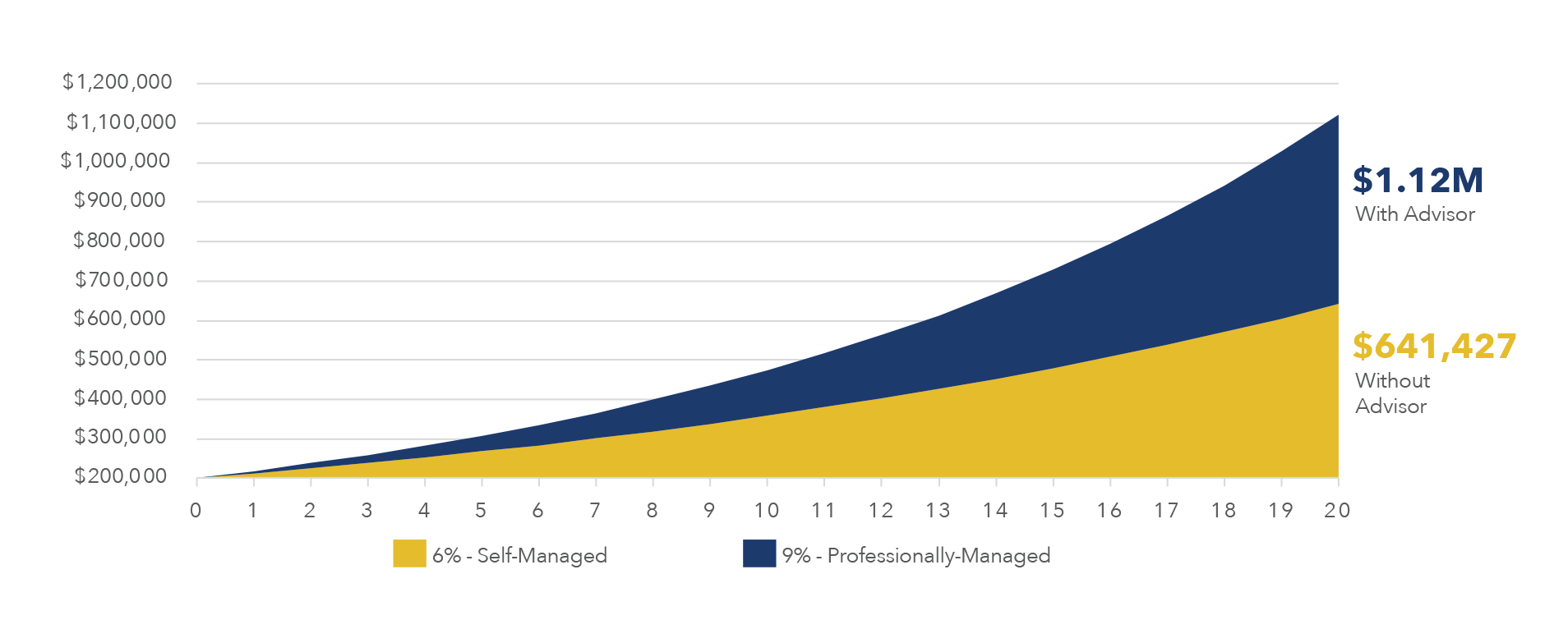

Studies show that professionally managed accounts outperform unmanaged accounts by 3.32%, net of fees. For a 45-year-old participant, this could translate to...

75% more wealth at age 65.1

Introducing the Personal Wealth Builder Program

through Nautica Asset Management

Federal Employees...you can prepare better for retirement.

Give your Financial Advisor the power to get you there.

Traditionally, accounts such as TSP, 401(k)s, 403(b)s and 529s were not managed by your Financial Advisor, putting you further behind your financial goals. Advisors could not provide the ongoing management and oversight that is expected and required as a fiduciary due to limitations in technology. Now, there is a solution for advisors to manage these assets.

Personal Wealth Builder Program enables your advisor to view, manage and trade any held away asset and provide you with the benefits of comprehensive portfolio management. This allows your advisor to do the job you hired them to do — full, holistic account management and wealth planning — and helps you to rest easy that all of your investable assets are being professionally managed.

Learn about Riskalyze

Calculate Your Risk

Comprehensive Account Management:

Consolidate all of your accounts with one trusted advisor.

Better Outcomes:

Have all of your accounts professionally managed.

Asset Allocation Strategies:

Optimize allocation and potentially reduce tax burdens.

Best Seller in Portfolio Management

#1 Bestseller and #1 Hot New Release in 11 different Amazon categories.

How to Avoid These Mistakes and Achieve Your Retirement Dreams"

That lack of information and inability for Federal Government employees to get guidance regarding their retirement and career benefits is truly alarming. Most government employees are unaware that many of the career-long benefits drop off at retirement and, as such, are not prepared for the consequences. It’s why so many federal employees are forced to find jobs after retirement. If you are a government employee, this book, the Eleven Common Mistakes Federal Employees Make Claiming Their Retirement Benefits; How to Avoid These Mistakes and Achieve Your Retirement Dreams was written specifically to help you achieve the dreams of retirement you aspire to.

Personal Wealth Builder Program Overview

Personal Wealth Builder makes it possible for Financial Advisors to manage their clients’ held away accounts. The platform empowers advisors to offer comprehensive, holistic wealth management to their clients by enabling held away account management and trading.

Advisors who use Personal Wealth Builder report that 88% of eligible clients adopt the technology. Personal Wealth Builder supports all major held away accounts, including TSP, 401(k)s, 403(b)s, 457s and more.

Gain efficiencies by managing all held away accounts through a single platform.

Provide better outcomes by having your held away accounts. (TSP) Professionally managed

Trading

The Personal Wealth Builder platform enables your advisor to communicate a trade or rebalance any type of account on your behalf.

Compliance

Personal Wealth Builder keeps your account in compliance with regulations and alleviates custody and security challenges on held away assets.

Security

Personal Wealth Builder is SOC 2 certified and adheres to the highest levels of security and encryption protocols to protect and secure all client data.

Our Security

Personal Wealth Builder is a trusted solution for thousands of Financial Advisors and some of the largest financial institutions in the world. We have invested millions of dollars into our security architecture to ensure that client data is protected and that our security program conforms to the highest standards in financial services.

- All systems are on a private network behind multiple, independent firewalls

- Systems are in a secured facility that is both physically and electronically safeguarded

- Access to servers is restricted to a limited number of system administrators

- Administrator security includes:

- Personal access keys

- IP restrictions

- Use of secure channels only

- SSL encryption for all traffic

- 256-bit encryption on all data

- Nautica meets Advanced Encryption Standards

- Anti-XSS to protect users as they interact with our system

- Anti-CSRF to help protect users from submitting unauthorized commands into the system [email protected]

Keeping Client Data Secure Provide a secure server environment Implement the highest levels of encryption on all identifiers and communication Institute additional security protections. For a copy of our SOC 2 certification, please reach out to us.

How much should you save? Learn more by using a calculator below.

Click a calculator below to learn more about how much you should save for retirement. These calculators were developed by the American Savings Education Council. They may help you calculate how much you need to save to reach your goals for retirement. If you need help calculating your retirement or would like to know more about these calculators, then reach out to Dave Baker by scheduling a one-on-one consultation here.

We Can :

Seamless Management

With Personal Wealth Builder, financial advisors can manage held away and retirement accounts like they do custodied accounts.

Integrated Planning and Reporting

Personal Wealth Builder integrates with existing technology to ensure that clients receive one comprehensive statement that covers all account activity and balances.

Tax Optimization Opportunities

Advisors can allocate their clients’ investments across taxable and tax-deferred accounts more efficiently using the Personal Wealth Builder platform.

We Can NOT :

Account Withdrawals

While Personal Wealth Builder enables a financial advisor to trade and manage their clients’ retirement accounts, they cannot withdraw funds from an account using the platform.

Beneficiary Shifts

With Personal Wealth Builder, clients remain in control of their accounts, which means that advisors cannot change beneficiaries.

Credential Sharing

Personal Wealth Builder is a client-permissioned interface: financial advisors do not need to know client passwords or login details in order to manage their accounts.

DAVE BAKER

Fiduciary Investment Advisor

Managing Director

Best Selling Author

Dave started working as a Financial Advisor in 1993. He grew up in Kalamazoo, MI which is a nice, well-rounded college town. In 2015, he returned to working independently. Dave is the author of three books regarding Federal benefits. Including one book that is a best seller on Amazon.

- Dave Baker

Dave is not a salesperson. He is a problem solver. That's the approach Dave brings to the table with clients so he can help them reach their financial goals and live their best lives.

Book 30 minutes with me.

Give your Financial Advisor the power to get you there.

Advisory services are offered through Nautica Asset Management LLC, a Registered Investment Advisor in the State of Michigan. Insurance products and services are offered through Nautica Insurance Group LLC. Nautica Asset Management LLC and Nautica Insurance Group LLC are affiliated entities.

1. Edelman Financial Engines and Aon Hewitt. Help in Defined Contribution Plans. May 2014. Research results presented for informational purposes only.

©2022. All rights reserved